My macro/industy Research

What I found right now?

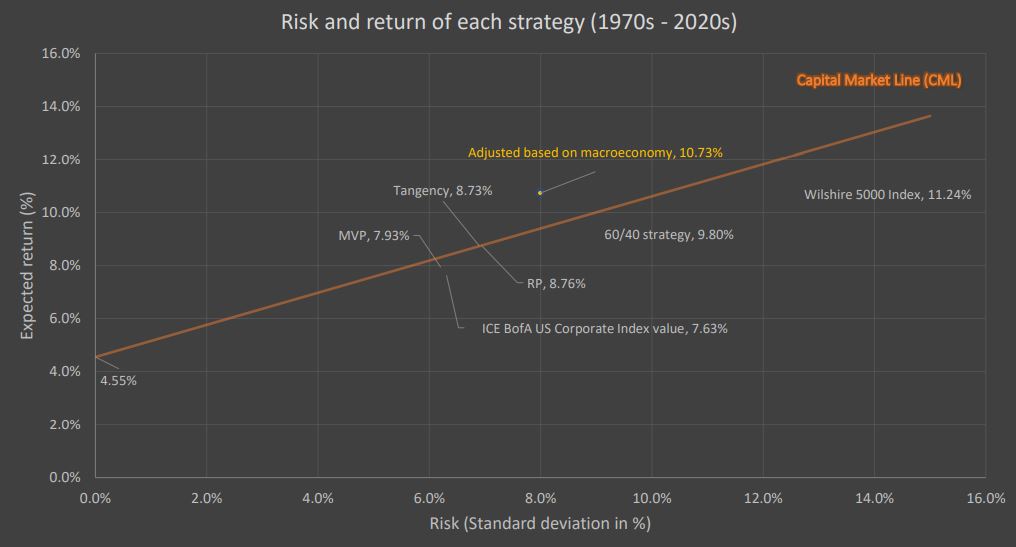

During studying the master degree in Investment Fundamentals with Roberto G´omez Cram, I have found that the portfolio adjusted the weight (between stock and bond) according the economy cycle outperformed over the market and other portfolio combination.This portfolio lies above the CML with higher Sharpe ratio at 77% compared with other portfolio at 48% - 66%, resulting from investing right asset classes at right market timing through adjusted portfolio weight according the economy cycle by short stock and long bond during the crisis, for instance.

Here how the data comes I collected the data about the return of stock (Wilshire 5000 Index) and bond (ICE BofA US Corporate Index value) from Dec 1972 to Jan 2021, combining with the Smoothed U.S. Recession Probabilities from FRED Economic data. Then, I computed the risk and return of 7 portfolio;

- Wilshire 5000 Index (100% stock portfolio)

- ICE BofA US Corporate Index value (100% bond portfolio)

- 60/40 strategy (60% stock and 40% bond portfolio)

- RP (Risk-Parity portfolio)

- MVP (Global minimun variance portfolio)

- Tangency portfolio

- Adjusted based on macroeconomy portfolio (based on Smoothed U.S. Recession Probabilities)